costa rica taxes vs us

The import tax charged on a shipment will be 13 on the full value of your items. Of the many cities offering flights to Costa Rica flights.

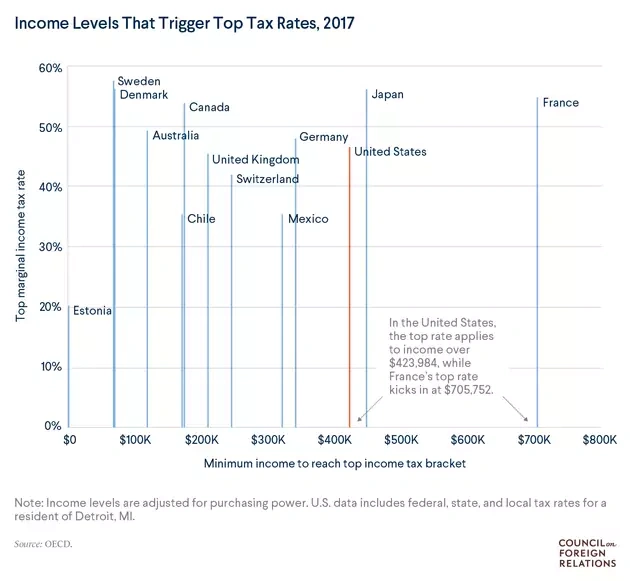

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

Per capita figures expressed per 1 population.

. GDP PPP Constant 2000 international Per capita. Up to 80 cash back The Tax Free Threshold Is 0 USD. How does Costa Rica compare to United States.

1 day agoCosta Rica became the first team to name their final 26-man roster for the 2022 World Cup in Qatar on Thursday November 3 nearly two weeks ahead of the deadline. New tax reform legislation in Costa Rica was passed 4 December 2018. 2022s tax was 69330 approximately US109 per inactive corporation.

For US income tax purposes these are corporations and must be reported on Form 5471. Taxpayers are required to file for taxes if their income exceeds a certain amount. The penalty for failing to file Form 5471 can be 10000 or more.

Compared to the region this puts the country on the lower end of individual tax rates. Now this tax applies to houses condos and apartments whose value of construction was beyond. Costa Rica ranked 80th vs 6th for the United States in the list of the most expensive.

The tax increases slightly each year and is due annually at the end of January. Living in Costa Rica or retiring in Costa Rica has many benefits and in this article we will weigh out the pros and cons. Income subject to tax in this country includes employment income self-employment business income.

The Tax Foundation is the nations. 48 more education expenditures. Has public health care.

Explore Costa Rica individual income tax system as well as property taxes consumption taxes and corporate taxes. The tax reform law includes significant income tax law changes such as the introduction of rules. In Costa Rica you might actually have to pay luxury task on your property.

Costa Rica calculates tax differently for different types of income. Last reviewed - 03 February 2022. The average cost of living in Costa Rica 893 is 1 less expensive than in the United States 2112.

Costa Rica has a progressive tax rate for individuals that ranges from 0 to 25. Single and 65 or older. Income taxes on individuals in Costa Rica are levied on local income irrespective of nationality and resident status.

Costa Rica vs United States. PPP GDP is gross domestic product converted to international dollars using. For example if the declared value of your items is.

Latin America Tax Revenue Caribbean Tax Revenue Tax Foundation

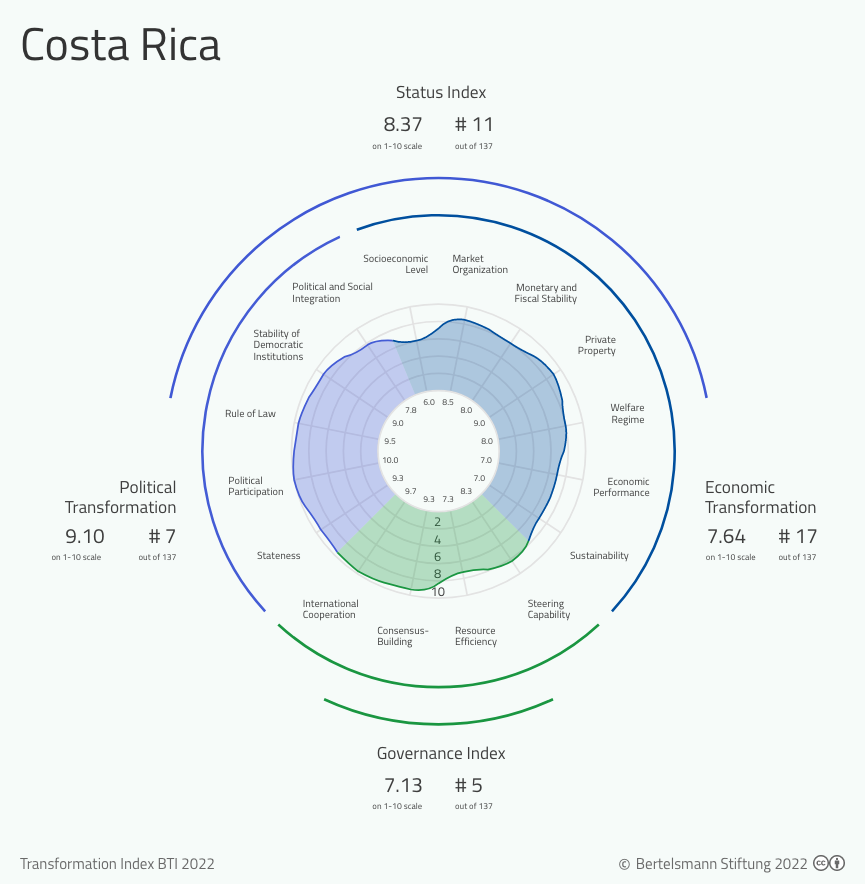

Bti 2022 Costa Rica Country Report Bti 2022

8 Things Americans In Costa Rica Need To Know About Expatriate Taxes Youtube

Us Taxes 1040 Nr For Non Residents

Healthcare In Costa Rica International Living Countries

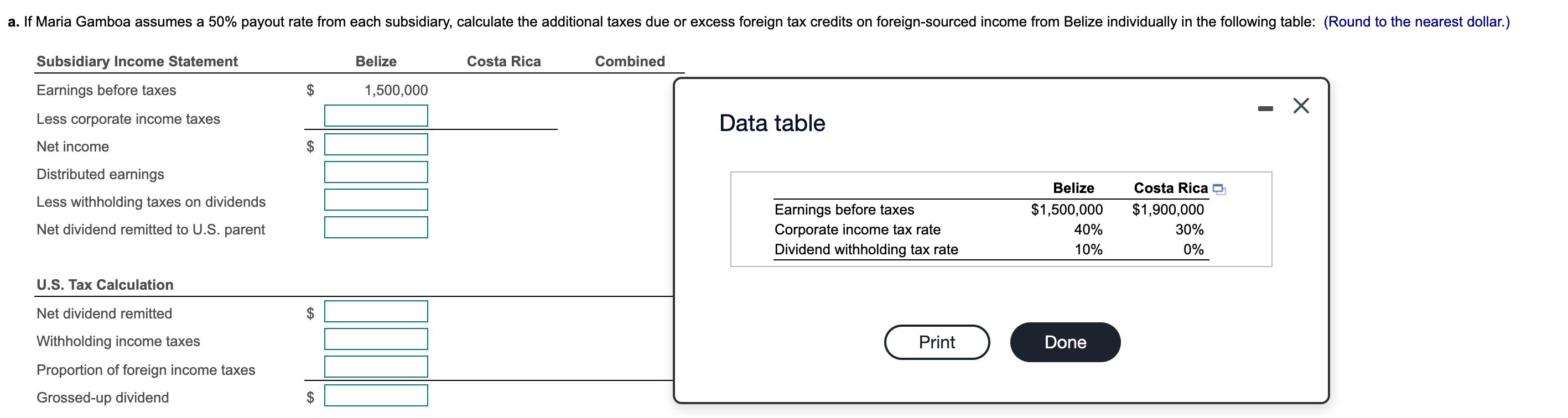

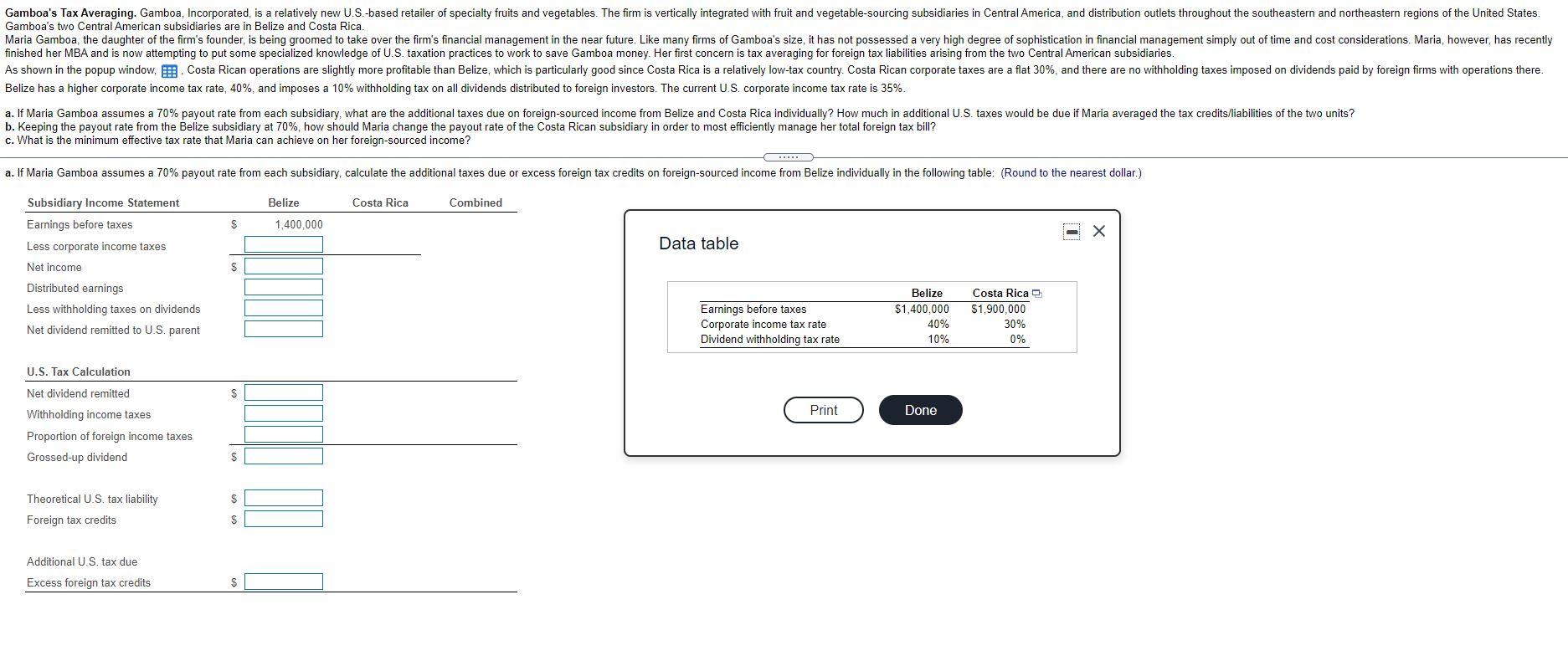

Gamboa S Tax Averaging Gamboa Incorporated Is A Chegg Com

Panama Vs Costa Rica Which Meets Your Must Have Criteria

Costa Rica S President No Growth And Poverty Reduction Without Economic Stability

Us Expat Taxes The Comprehensive Guide 2021 Online Taxman

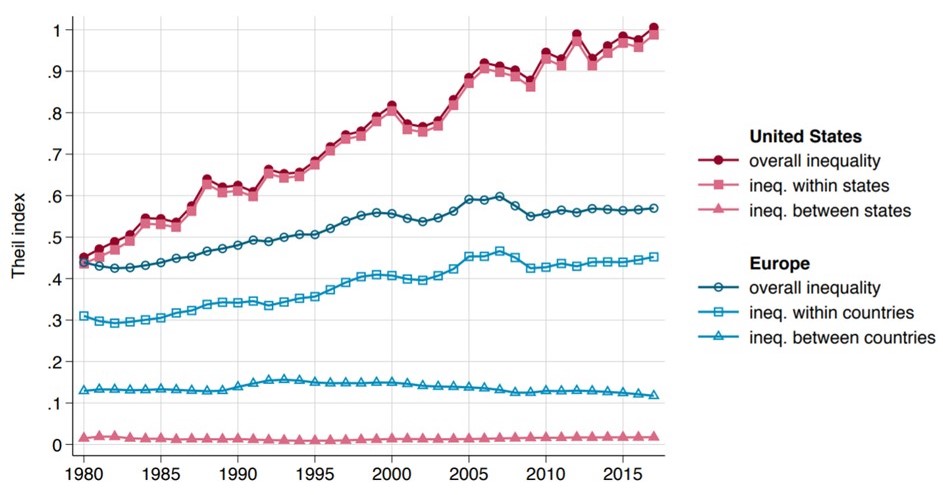

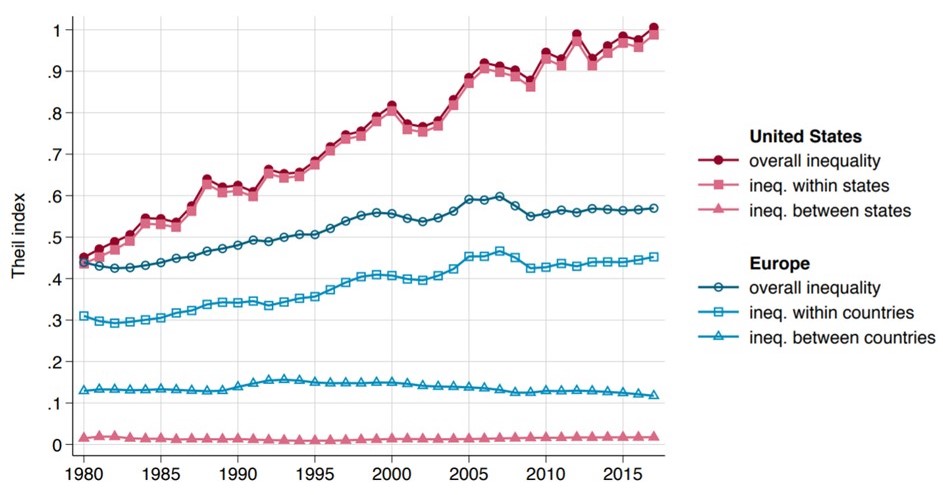

Why Is Europe More Equal Than The United States Wid World Inequality Database

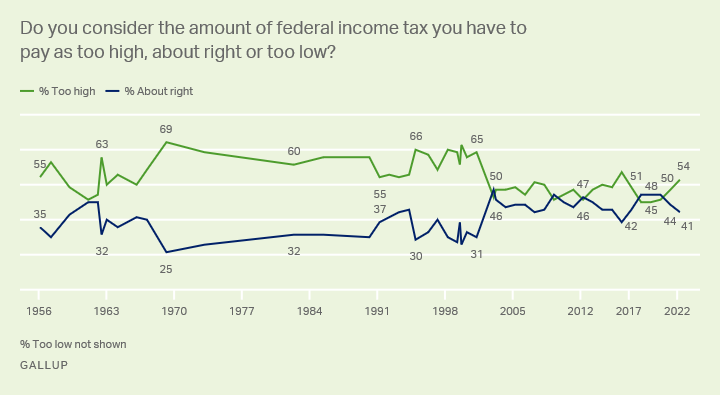

Taxes Gallup Historical Trends

Taxes In Costa Rica International Living Countries

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

10 Different Coins From Costa Rica Central American Collectible Money Colones Ebay

Comparing Taxes As A Percentage Of Sugar Sweetened Beverage Prices In Latin America And The Caribbean The Lancet Regional Health Americas

Costa Rica Sales Tax Rate Vat 2022 Data 2023 Forecast 2006 2021 Historical